Living in Durango CO vs Grand Junction

I’ve had several people call that are comparing living in Durango CO vs Grand Junction when they are researching moving to Colorado. Both Grand Junction and Durango, Colorado, offer appealing lifestyles in our very scenic western Colorado, but they cater to slightly different preferences. And when you are moving, I understand you want the scoop in comparing the two cities before buying a house in Colorado.

Here’s my comparison across lifestyle, housing costs, outdoor activities, retirement appeal, and access to mountain biking, an airport and healthcare. Let me know what specific questions you have. Call/text me anytime 612-306-9558.

If you have a topic you’d like me to write about, send me an email.

Get notifications about new posts and watch my short videos on my Facebook page called Live Your Vacation in Grand Junction.

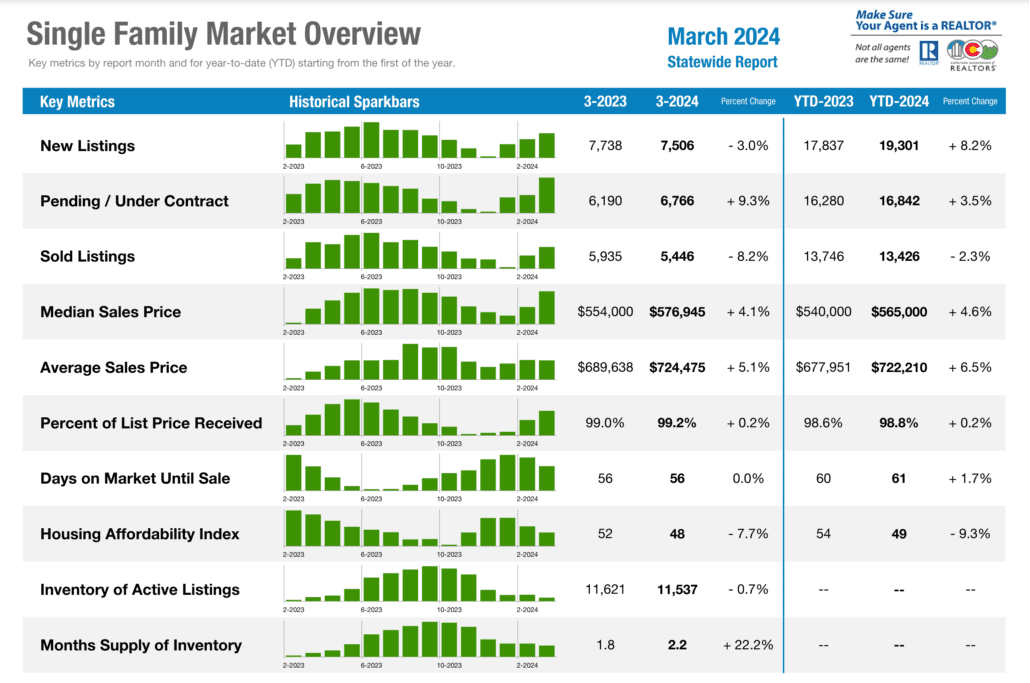

Housing Costs

- Grand Junction:

- Generally GJ is more affordable than Durango which is great for budget-conscious buyers and retirees and the general population.

- Median home prices (as of late 2024) hover around $375K–$425K.

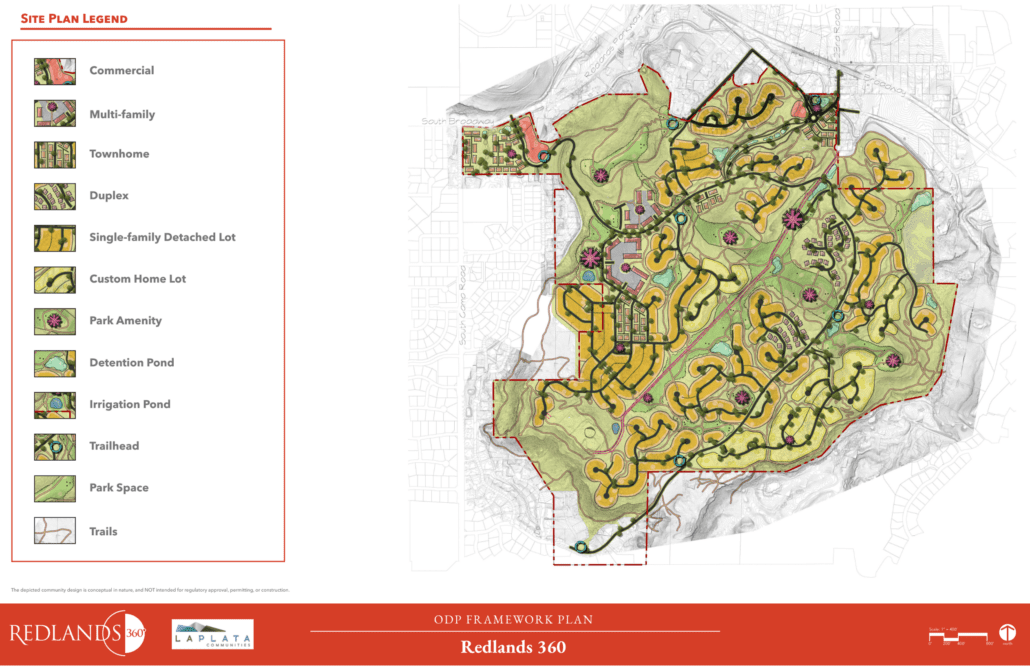

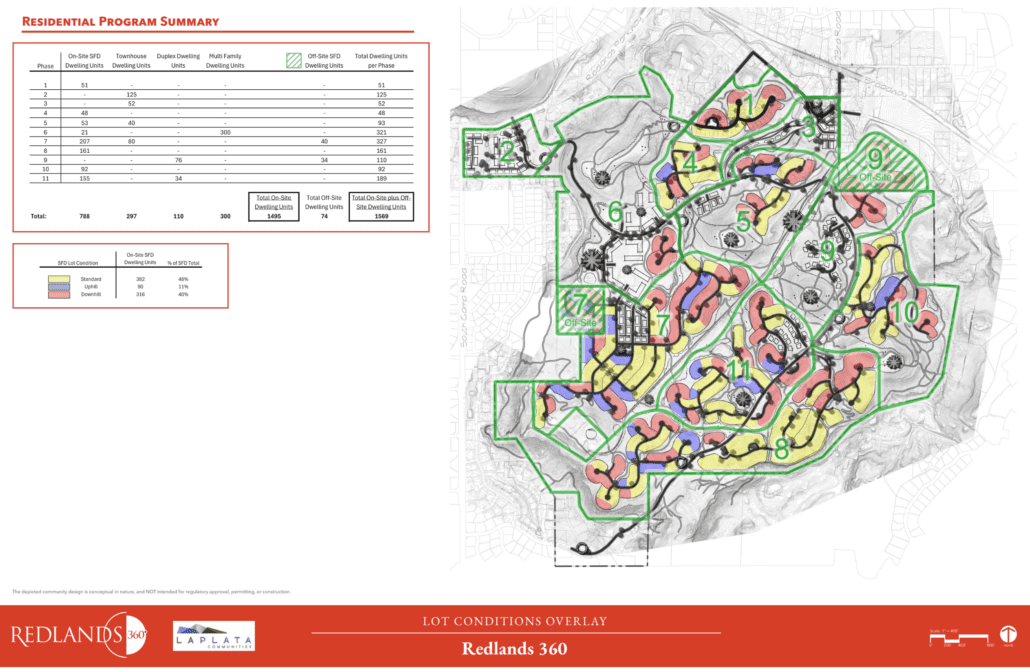

- More housing inventory, including 55+ communities and urban or suburban developments. I have relationships with several local home builders and insight into new communities that are being developed, like Redlands 360.

- Lower property taxes compared to many Colorado resort towns. Read my post about Property Tax incentives for seniors in Grand Junction.

- Durango:

- More expensive, with median home prices often $500K–$600K+, driven by the fact that it’s considered a resort town.

- Limited space for expansion keeps housing inventory tight.

- Attracts wealthier second-home owners, which can inflate prices.

Outdoor Activities

- Grand Junction:

- A beautiful gateway to the Colorado National Monument, the Grand Mesa, and the Book Cliffs (mountains surrounding the Grand Valley).

- Year-round golfing, biking, hiking, walking, river rafting and floating, plus quick access to world-class desert and alpine trails.

- The Grand Mesa offers fishing, camping, hiking, skiing, snowmobiling and plenty of resorts and rustic cabins and an alpine forest just 45 minutes away.

- Nearby Palisade wine country offers a quaint downtown, wine tours and fantastic farmers markets in summer.

- Fruita is just 10 minutes away and offers an abundance of trails for mountain biking, hiking and trail riding on your horse or ATV. (McInnis Canyons Conservation area is spectacular!)

- Close to Utah’s red rock country and more mountain biking, hiking and jeeping in Moab, just 90 minutes away. Read my Top Day Trips post.

- Grand Junction is a place where desert-meets-mountain. It’s about 4 hours to Denver or Salt Lake City, UT.

-

Animas River Durango area

Durango:

- Surrounded by the stunning San Juan Mountains—excellent for hiking, backpacking, and skiing.

- Purgatory Resort offers accessible skiing and snowboarding.

- More snow-based recreation, excellent for winter sports lovers.

- Summer activities like white water rafting, tubing, and kayaking on the Animas River.

- Home to the Durango & Silverton Narrow Gauge Railroad, a scenic tourist ride!

- The closest major city to Durango, Colorado is Albuquerque, New Mexico, about a 3.5-hour drive south.

Lifestyle & Community

- Grand Junction:

- Larger population (~65,000), with more healthcare options and shopping (REI, department stores and mall, Target, and three hospitals).

- A bit more urbanized, more infrastructure and services with a growing arts and food scene.

- Conservative-leaning politically, though varied across age groups.

- Less of a tourist hub, so a steadier year-round pace.

- Colorado Mesa University with ~10,000 students and community education classes for the community.

- Durango:

- Smaller (~20,000), more intimate, and community oriented.

- More outdoorsy and liberal-leaning culture.

- Strong college-town vibe (Fort Lewis College up on the hill), with seasonal tourists.

- Tight-knit feel due to much lower population, with more second-home owners and seasonal residents.

Retirement Appeal

Grand Junction:

Grand Junction:

- Popular with those working and retirees due to affordable living, dry climate, and medical facilities (see healthcare below).

- More age-friendly services and communities (see Why Retire in GJ post that includes info about CMU courses for retirees at a reduced rate).

- Milder winters than Durango – less snow, more sun.

- Durango:

- Beautiful place to live and retire if your budget allows living in a resort mountain town.

- Winters can be harsh for those not acclimated to snow and altitude (~6,500 ft).

- Higher cost of living can be a barrier.

Walkability

- Grand Junction:

- The downtown core (beautiful pedestrian-friendly Main Street area) is walkable with restaurants, breweries, galleries, theater, and a variety of shops.

- Outside downtown, it’s more car-dependent, especially in North Grand Junction and newer developments along the outskirts.

- Mixed-use neighborhoods are growing.

- Public transit is available and bike lane/trail connections are numerous.

- Durango:

- More walkable, especially in the historic downtown area.

- Strong pedestrian and bike culture with trails that connect many parts of the city.

- Smaller footprint makes walking feasible for more daily activities.

Mountain Biking Access

- Grand Junction:

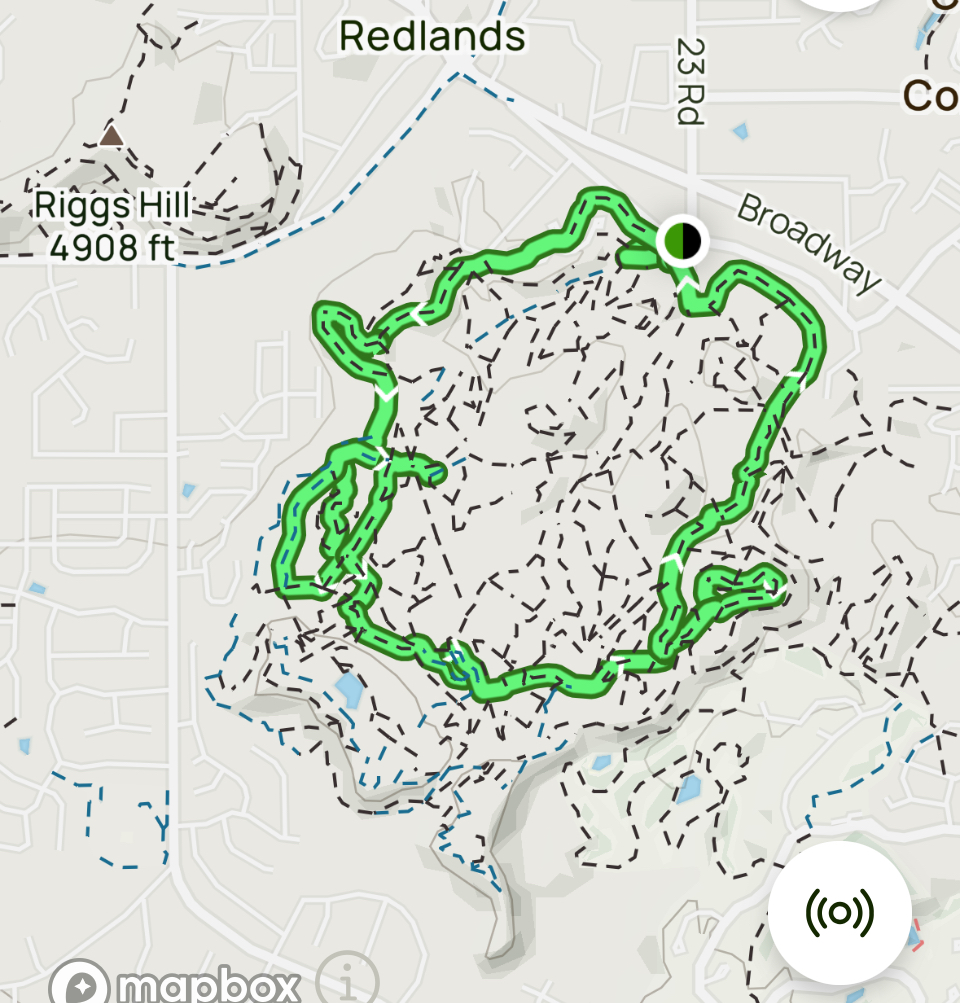

- One of the top desert mountain biking destinations in the country.

- Lunch Loops, Kokopelli Trail (Fruita to Moab, UT), and 18 Road in North Fruita are world-famous and very close. Plus, let’s not forget all the trails in McInnis Canyons Conservation Area and the newer Palisade Plunge from the top of the Grand Mesa!

- Trails range from beginner to technical desert singletrack.

- Easily accessible from town—many riders pedal to the trailheads from home in certain neighborhoods. Read my guest post from a local mountain biker.

- Year-round access and variety in the Grand Valley, some go up to the Mesa during the warmer summer months for a cooler climate for riding.

- Durango:

- Also excellent, especially for alpine terrain lovers.

- Horse Gulch, Telegraph Trail System, and Colorado Trail are directly accessible from town.

- Terrain is steeper and more forested than Grand Junction.

- More high-altitude riding, which limits accessibility during snowy months.

- Biking is best in summer/fall months.

Airport Access

-

Sign near the GJT airport

Grand Junction:

- Grand Junction Regional Airport (GJT) is just 10–15 minutes from downtown GJ, Fruita or Palisade.

- Offers direct flights to Denver, Phoenix, Dallas, Salt Lake City, Las Vegas, Los Angeles (Orange County) and San Francisco.

- Small but efficient regional airport—very convenient and reliable. Read about our GJT Airport Experience – no waiting at the curb!

- Durango:

- Durango–La Plata County Airport (DRO) is about 20 minutes from downtown.

- Also offers direct flights to major hubs like Denver, Dallas, Phoenix, and seasonal options.

- Slightly fewer flights and destinations than GJT, but still good. Snow may cause delays.

Healthcare Access

- Grand Junction:

- Known for strong healthcare infrastructure for our size.

- Home to Family Health West in Fruita, Community Hospital, renowned St. Mary’s Hospital and Regional Medical Center (Level II trauma center) that serves communities within 2 hours of the Grand Valley, plus the Grand Junction VA Medical Center.

- Broad network of specialists and clinics—highly rated.

- The best healthcare hub between Denver and Salt Lake.

- Durango:

- Primary provider is Mercy Regional Medical Center, a quality full-service hospital.

- Fewer specialist options locally, so more complex care may require travel to Grand Junction or Albuquerque, NM (3.5 hours away).

- Good for routine and emergency care, but limited depth in specialties.

Grand Junction vs Durango Comparison Chart

| Factor | Grand Junction | Durango |

| Housing Costs | ✅ More affordable, more inventory | ❌ Higher real estate prices |

| Outdoor Activities | ✅ Desert & alpine variety | ✅ Mountain & snow-based fun |

| Lifestyle | ✅ More urban conveniences | ✅ Quaint, outdoorsy vibe |

| Retirement Appeal | ✅ Budget-friendly, mild | ❌ Costly but scenic |

| Walkability | ✅ Very walkable downtown, bike lanes available | ✅ Very walkable, compact downtown |

| Mountain Biking Access | ✅ Year-round, world-class desert trails | ✅ High-alpine trails, seasonal access |

| Airport Proximity | ✅ More direct flights, easy access (GJT) | ✅ Good airport, slightly fewer flights (DRO) |

| Healthcare Access | ✅ Strong hospital system & specialists | ❌ Fewer specialists, limited complex care |

Final Thoughts

Choose Grand Junction vs living in Durango CO if you value overall affordability, accessibility to national parks, more housing options, year-round riding/golfing, and all the typical suburban amenities and small-town charm. I compared just a few topics. There’s more to learn about living in Grand Junction, Fruita and Palisade, so keep reading!

The last time I was in Durango I noticed a lot of trucks, SUVs, campers and trailers going down the main road. Hardly anyone drives a sedan in Durango. I guess with more snowfall, everyone wants 4×4 or at least all-wheel drive, LOL!

Grand Junction is ideal if you are working in person or remotely, retired, semi-retired or consider yourself an active adult who wants a variety of terrain and opportunities with strong medical support. You want a place your friends, children, and grandchildren want to come visit because there’s so much to do! Read my post that explains how important this can be.

At Molas Pass just north of Durango

Call/text me at 612-306-9558 if you are coming into town and want to connect with me. I’d be happy to show you around Grand Junction, Fruita and Palisade to help you compare the Grand Valley to Durango, or buying a house in Colorado communities you may be considering.

Experience the Grand Junction Lifestyle!

PAUL ASPELIN, your Grand Junction Real Estate Expert

REALTOR®, GRI, SRES®, CNE

Connect with me on LinkedIn

Licensed in Colorado – Serving Mesa County

Learn more about how I work with my clients

Live Your Vacation Every Day… Move to Grand Junction!

© 2025 Paul Aspelin, REALTOR® MovetoGrandJunction.com. Copyright protected. All Rights Reserved.

Grand Junction:

Grand Junction:

Financing Contingency: The offer is contingent on the buyer securing a mortgage loan.

Financing Contingency: The offer is contingent on the buyer securing a mortgage loan. If you’re wary of writing a home sale contingent offer, consider these alternatives:

If you’re wary of writing a home sale contingent offer, consider these alternatives:

Are you a real estate agent looking to refer your out-of-town or out of state clients to a REALTOR® that can get the job done? I welcome your call to discuss your client’s needs and how I can best represent them for a successful closing. Whether your clients need to sell a home in the Grand Valley or relocate to this amazing community, I will make you look like a rock star!

Are you a real estate agent looking to refer your out-of-town or out of state clients to a REALTOR® that can get the job done? I welcome your call to discuss your client’s needs and how I can best represent them for a successful closing. Whether your clients need to sell a home in the Grand Valley or relocate to this amazing community, I will make you look like a rock star!

Text/Call 612-306-9558

Text/Call 612-306-9558