Grand Junction Mortgage Expert

Why work with a local Grand Junction Mortgage Expert?

Guest Post written by Nicole Sears of Fairway Independent Mortgage Company

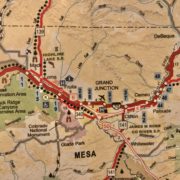

Are you considering a relocation and home purchase in Grand Junction, Colorado? Finding the right local Grand Junction Mortgage expert is essential for a smooth transition. Whether you need to further understand first-time homebuyer mortgage requirements, or home mortgages for self-employed people, a local Grand Junction mortgage expert can help guide the way.

Fairway Independent Mortgage Company is located on the corner of Main Street and 6th Street in downtown Grand Junction, Colorado

As a mortgage expert who made the transition from Denver to Grand Junction, Colorado eight years ago, I understand the complexities and excitement that come with such a significant decision. In this guide, we’ll explore the relocation journey to Grand Junction and how a local Grand Junction Mortgage expert can help. Everything from navigating first-time homebuyer mortgage requirements to understanding home mortgages for self-employed people can be overwhelming without the help of a local Grand Junction Mortgage expert.

When it comes to securing a home loan, many people become frozen in their circumstances. It’s common to feel a bit overwhelmed with the mortgage process when buying a new home. This is one of the reasons it is so important to partner with a local Grand Junction Mortgage expert. You’re already dealing with everything else that comes along with your relocation to Grand Junction, allow me to help make this transition seamless and tailored to your needs. It’s my specialty!

Seven tips for starting the Home Loan Process when relocating to Grand Junction, Colorado

- Professional Advice: Seek guidance from a local Grand Junction mortgage expert like myself that is familiar with the Grand Junction market nuances. Our dedicated team at Fairway Independent Mortgage Company is committed to assisting you at every step, from pre-approval to closing, fostering lasting relationships beyond transactions.

- Start Early: Initiate your mortgage journey in advance to explore available options and make informed decisions aligned with your financial goals. Our goal is to provide clarity on interest rates, down payments, closing costs, and programs you may be eligible for. This all ensures a smooth and transparent process.

- Secure a Transfer or Job Offer Letter: Dispelling the myth that homeownership requires years with the same employer, you can initiate the process with a solid job offer. At Fairway Independent Mortgage Company, we specialize in facilitating smooth transitions, ensuring you secure your dream home even before your first day on the job.

- Remote Work Success: For remote workers transitioning to Grand Junction, our expertise lies in navigating the intricacies of remote employment and facilitating a seamless move. Our diverse mortgage programs cater to varying needs, offering solutions tailored to individual circumstances.

- First-Time Homebuyer Mortgage Requirements: Buying your first home should be an exciting time, however most first-time buyers are unsure of the process and don’t know where to start. Working with a trusted local mortgage expert ensures personalized guidance and support every step of the way. We are here to help navigate the path to homeownership and ensure you’re aware of all available loan and down payment opportunities specific to the Grand Junction area.

- Home Mortgages for Self-Employed People: Many people believe that lenders view their self-employment status as a barrier to obtaining a mortgage. However, with the guidance of a knowledgeable Grand Junction Mortgage expert, self-employed individuals can discover tailored solutions and specialized programs designed to accommodate their unique financial circumstances. We are experts in calculating and maximizing self-employed income and empowering self-employed individuals to achieve their homeownership goals with confidence.

- Diverse Mortgage Programs: Whether you’re one of the many self-employed people, a remote worker, first-time homebuyer, retired or military, our mortgage programs encompass Conventional loans, FHA loans, VA loans, and USDA loans, designed to meet your specific requirements. Our team is dedicated to helping you find the ideal financing solution for your unique situation.

Embarking on the journey to homeownership may seem daunting, but when you work with a local Grand Junction Mortgage expert, it becomes manageable.

At Fairway Independent Mortgage Company, we prioritize building lasting connections with our clients. Beyond being a mortgage lender, I consider myself a friend and partner in your homeownership journey.

Whether you’re curious about mortgages, local amenities, or outdoor activities, I’m here to assist you. As someone who has undergone a similar relocation journey, I understand the importance of having a relatable resource.

Ready to embark on your homeownership journey in Grand Junction? Reach out with any questions or inquiries. I’m not just your mortgage advisor—I’m your partner in turning homeownership dreams into reality.

You might also enjoy the posts written by Paul Aspelin about Retiring in Grand Junction, Relocating to Grand Junction and Why Move to Grand Junction.

Nicole Sears – NMLS #1329851

Loan Officer

Nicole.Sears@fairwaymc.com

(720) 338-8764

Fairway Independent Mortgage Company

601 Main Street

Grand Junction, CO 81501

© 2024 Paul Aspelin, Realtor® and Nicole Sears, Loan Officer. Copyright protected. All Rights Reserved.